Fed’s Rate Cut Marks Shift: Inflation and Labor Data to Determine Next Steps in Easing Cycle

Explore the impact of Fed’s Rate Cut Marks Shift on inflation and labor data. Discover how Fed’s Rate Cut Marks Shift shapes next policy steps.

Zeynep Kucukkirali

4 Min Read

Sep 26, 2024

The Federal Reserve (Fed) ended its long-standing hawkish stance last week by making a jumbo 50 basis point rate cut, bringing interest rates down to the 5.75%-5.00% range. Following the Fed’s aggressive start to its policy easing cycle, discussions continue around its potential next moves. This week, critical data releases from the U.S. could shape the direction of market expectations.

Fed's Next Move Hinges on Data: Inflation or Labor Market?

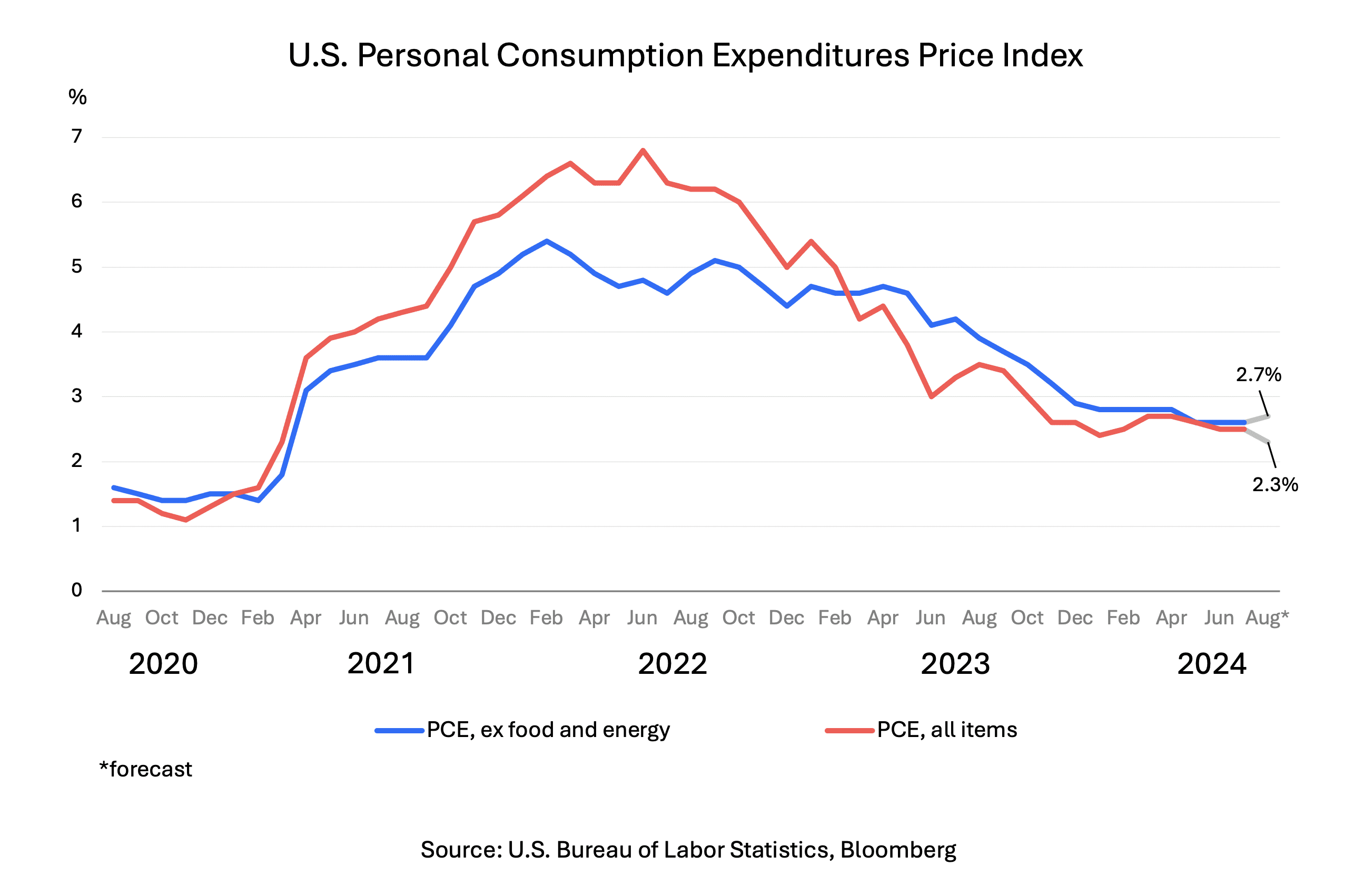

Before the September meeting, some Fed officials emphasized that their focus had shifted from inflation to risks in the labor market. Indeed, while the inflation reports leading up to the meeting showed an easing in the headline figure, the core index, excluding food and energy, remained sticky, supporting views in favour of a gradual rate cut. As a result, the 50 basis point rate cut was interpreted as a move aimed more at supporting the labor market than addressing the decline in inflation.

However, statements from some officials emphasized that inflation data remained a key factor driving policy decisions. Fed Governor Michelle Bowman, who was the sole dissenting vote against the half-point cut, pointed to ongoing inflation risks and signaled her support for a more gradual rate cut approach.

On the other hand, Fed Governor Christopher Waller stated that the factor convincing him to support the half-point cut was not labor market risks but favorable inflation data. He expressed concerns that inflation might be trending weaker than anticipated.

While officials have expressed differing views, they are aligned in signaling that decisions will be data-dependent. For the Fed to be more convinced of another 50 basis point rate cut, upcoming inflation data would need to come in lower than expected, or labor market data would need to show deterioration. However, if the labor market remains strong and inflation cools slowly, this could make a gradual easing cycle with a 25 basis point cut the base scenario.

In an extreme scenario, if inflation rises above expectations, it could interrupt the rate-cutting cycle. However, such a decision is unlikely to be preferred as it could cause a shock in financial markets.

Economists Forecast Slower Headline Inflation but Rising Core Prices

According to the median estimates of economists surveyed by Bloomberg, the headline Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, is expected to slow to 2.3% in August from the previous 2.5%. On a monthly basis, the increase is forecasted to be 0.15%.

Meanwhile, the core PCE index, which excludes food and energy prices, is projected to rise by 0.2% month-over-month, with an annual increase of 2.7%. If the data aligns with expectations, this would mark the first increase in core PCE after three consecutive months of stability at 2.6%.

Markets Eye Fed's Next Move Amid Inflation and Labor Concerns

While policymakers have clearly stated they do not want to see further cooling in the labor market, it appears they agree that the current situation remains healthy. However, concerns among U.S. households are growing; consumer confidence recorded its sharpest decline in three years in September, highlighting fears about the labor market.

Although the current situation does not suggest immediate urgency, markets are considering the possibility of another half-point rate cut by the Fed to prevent further cooling. According to futures market data, the baseline scenario, with a 62.2% probability, is for another half-point reduction in November. However, ahead of next week’s non-farm payrolls and unemployment reports, today’s growth figures and tomorrow’s inflation report are key in shaping expectations.

If weak growth data is added to labour market concerns and inflation figures do not show significant gains, expectations for a 50 basis point rate cut could gain traction, putting additional pressure on the U.S. dollar.

However, current economic data does not indicate a critical slowdown in the U.S. economy. Should growth data confirm this, and if Friday’s inflation report doesn’t show a significant cooling, the baseline scenario may shift toward gradual rate cuts. In this case, the pressure on the U.S. dollar may ease somewhat, and we could see a pullback in precious metals, which have reached record levels.