Week Ahead: Consumer Prices, Trade Tensions, and Gold Rally

Markets eye U.S. inflation data amid Trump's tariff escalation and growing recession fears – will Wednesday's CPI report push the Fed to cut rates sooner?

Zeynep Kucukkirali

4 Min Read

Mar 10, 2025

10 March, 2025 - Markets face uncertainty as economic data shows mixed signals: U.S. job growth remains solid despite rising unemployment, while Trump's escalating tariff policies heighten trade war risks with Canada and Mexico. Fed officials remain cautious amid recession concerns, with Wednesday's CPI data crucial for rate expectations. Gold benefits from safe-haven demand as the dollar weakens.

Key Events and Data to Watch This Week

Monday:

07:00 - Germany Industrial Production (Jan)

07:00 - Germany Trade Balance (Jan)

09:30 - Eurozone Sentix Investor Confidence (Mar)

23:30 - Australia Westpac Consumer Confidence (Mar)

23:50 - Japan Gross Domestic Product (Q4)

Tuesday:

00:01 - UK Retail Sales (Feb)

15:00 - US JOLTS Job Openings (Jan)

Wednesday:

12:30 - US Consumer Price Index (Feb)

13:45 - Canada BoC Interest Rate Decision

Thursday:

00:00 - Australia Consumer Inflation Expectations (Mar)

10:00 - Eurozone Industrial Production (Jan)

12:30 - US Initial Jobless Claims (Mar 7)

12:30 - US Continuing Jobless Claims (Feb 28)

12:30 - US Producer Price Index (Feb)

Friday:

07:00 - Germany Harmonized Index of Consumer Prices (Feb)

07:00 - UK Gross Domestic Product (Jan)

07:00 - UK Industrial Production (Jan)

09:30 - UK Consumer Inflation Expectations (Mar)

14:00 - US Consumer Sentiment Index (Mar) Prel

14:00 - US Consumer Inflation Expectations (Mar) Prel

What Do February Job Numbers Tell Us? Unemployment, Wages, and Consumer Spending in Focus

On Friday, data indicated that job growth in the U.S. remained solid, while the unemployment rate edged higher—presenting a mixed picture of the labor market amid uncertainties.

The U.S. Bureau of Labor Statistics (BLS) reported that nonfarm payrolls increased by 151,000 in February, following a downward revision of the previous month's gains. Job growth missed economists' median forecast of 160,000 and came in below the prior 12-month average of 168,000. Meanwhile, the unemployment rate ticked up slightly to 4.1% from the previous 4%.

The February employment figures only partially reflected the impact of federal job cuts due to the earlier survey date. According to recent data, total federal job losses exceed 60,000, but only 10,000 were reported in the February figures. This suggests that upcoming labor market data could face additional downward pressure due to federal layoffs.

The report also highlighted that hiring remained steady throughout February, labor force participation fell to a two-year low, the number of long-term unemployed increased, and the ranks of those working part-time for economic reasons grew.

These trends provide further evidence that the U.S. labor market is gradually softening amid uncertainty surrounding the new administration's policies. However, job gains remain at a solid pace, and the unemployment rate is still historically low. As a result, the current figures do not signal a deterioration in the labor market, yet they reinforce concerns about economic risks during a period of heightened uncertainty driven by Donald Trump's policies.

On the other hand, the BLS report revealed that the number of individuals working multiple jobs reached a record high of approximately 8.9 million in February. This aligns with the findings of an earlier consumer survey. U.S. households continue to struggle with high interest rates and persistent inflation, leading to rising debt burdens and forcing consumers to be more selective in their spending.

Federal Reserve data released on Friday provided additional evidence of these financial strains. As borrowing costs remained elevated, the pace of household borrowing slowed in February, and difficulties in debt repayment increased. A record share of consumers is now making only minimum payments on their credit cards. Additionally, the rate of missed auto loan payments has surged to its highest level in over 30 years, while delinquent consumer debt has reached a five-year peak.

Over the past year, consumer spending had been supported by robust income growth despite high interest rates. However, weakening labor demand now appears to be slowing wage growth. Average hourly earnings rose by 0.3% in February after a downwardly revised 0.4% increase the previous month. On a year-over-year basis, earnings were up 4%, missing the forecast of 4.1%.

This has fueled speculation that consumer spending—the driving force of the U.S. economy—could come under pressure amid a weakening labor market and slowing income growth, potentially dampening economic growth.

U.S. Faces Rising Trade War Risks as Trump Escalates Tariff Policies

Meanwhile, the U.S. economy is grappling with uncertainty caused by Donald Trump's tariff policies and facing an increasing risk of a trade war.

Last week, Trump imposed 25% tariffs on Canada and Mexico and doubled the duties on China. Later, he announced that products covered under the USMCA would be exempt from tariffs until April 2. However, he continues to push forward with tariff measures, escalating tensions.

On Friday, Trump accused Canada of ripping off the U.S. for years with its tariffs on lumber and dairy products and vowed to impose retaliatory tariffs. He stated that these tariffs could be announced by Monday or Tuesday. Additionally, the tariffs on steel and aluminum are set to take effect on Wednesday, with more measures expected to follow.

These successive moves are fueling concerns that the new administration's trade policies could push the U.S. economy into a recession, amid slowing economic activity, stubborn inflation, and declining business and consumer confidence.

Trump dismissed concerns that tariffs and federal spending cuts could pose risks of an economic slowdown, insisting that the U.S. economy is in a transition period. However, his actions—combined with retaliatory tariffs announced by affected countries—are doing little to ease market fears.

In Canada, Mark Carney, who was elected prime minister in place of Justin Trudeau, declared in his victory speech on Sunday that Canada would respond with counter-tariffs as long as Trump insisted on a trade war. Last week, Canada imposed a 25% retaliatory tariff on over $20 billion worth of U.S. imports and is threatening to extend the measure to goods worth over $100 billion.

Meanwhile, statements from Mexico over the weekend indicated that if the delayed tariffs are implemented, Mexico will have no choice but to retaliate.

Markets Shift Focus to Recession Risks as Trump's Policies Spark Uncertainty

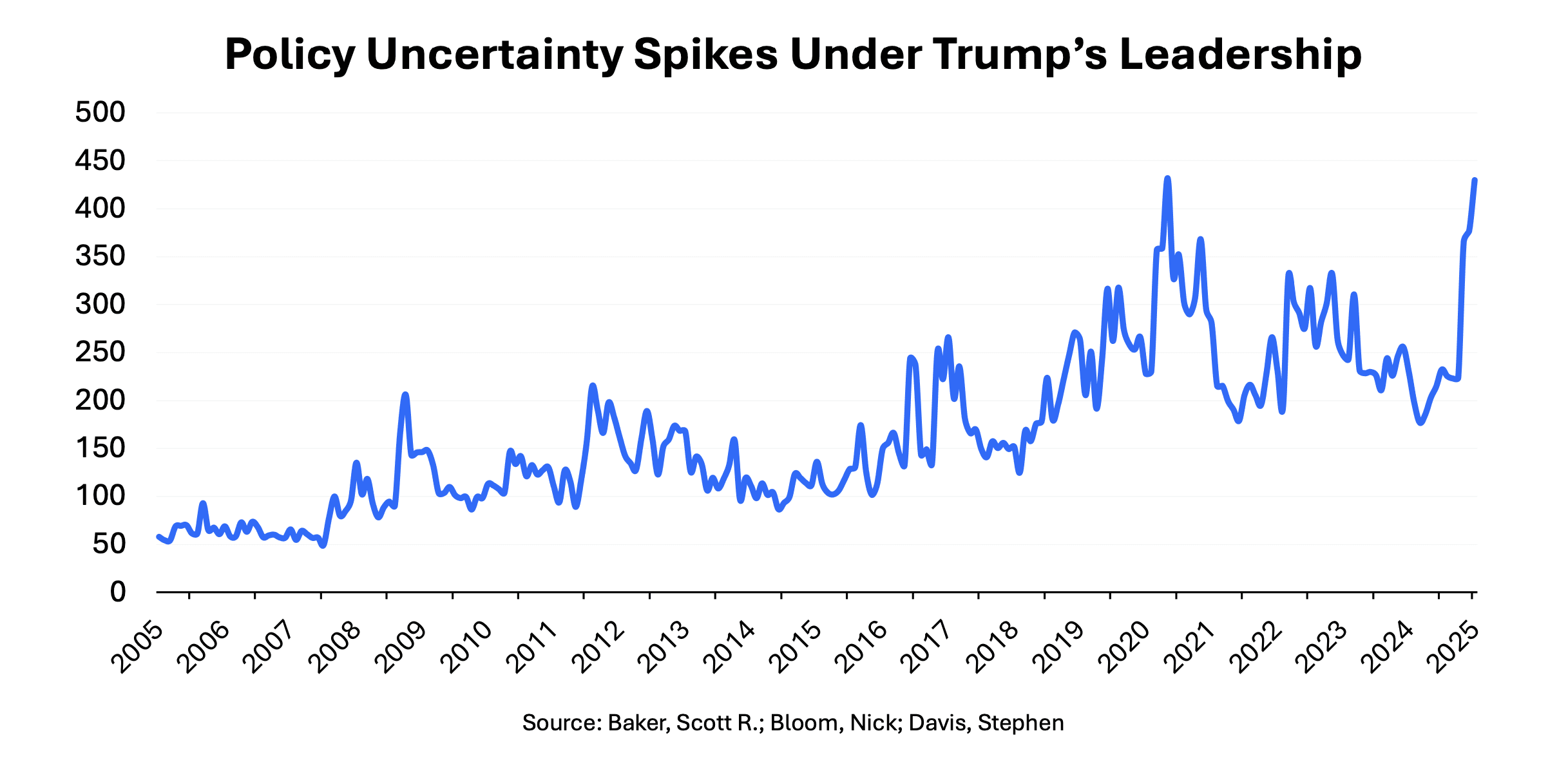

Since Trump's election victory, speculation that he would unleash stimulus and accelerate growth has quickly faded, leading to a shift in market sentiment. Economic policy uncertainty is rapidly rising toward pandemic-era peaks, and markets now see higher recession risks due to the sequencing of Trump's policies—tariffs first, tax cuts later.

This shift has fueled a transition from expectations that the Fed would not cut rates at all this year to bets on three-quarter point rate cuts. However, Fed officials remain cautious.

Speaking at an event on Friday, Fed Chair Jerome Powell acknowledged the growing uncertainties surrounding the economic outlook but emphasized that the economy remains in a good place and that there is no urgency to adjust policy. Powell stated, "We are well-positioned to wait for more clarity on the effects of policy changes."

Powell's cautious stance was echoed by other Fed officials. A handful of policymakers highlighted ongoing uncertainties and stressed that they would need more evidence of inflation moving toward the target before considering another rate cut.

Against this backdrop, markets will closely watch Wednesday's U.S. Consumer Price Index (CPI) and Thursday's Producer Price Index (PPI) data. The core CPI, which excludes volatile components, is expected to have slowed to 3.2% in February from 3.3% previously, highlighting the gradual progress in inflation.

As Duhani Capital Research, we believe that such a scenario will likely keep market focus on growth risks, suggesting that the U.S. dollar will remain under pressure.

Safe-Haven Demand Drives Gold Higher as U.S. Recession Risks Mount

Gold is benefiting from safe-haven demand amid growing concerns about the global economic outlook. Last week, gold closed with a nearly 2% gain, as trade tensions escalated following actions taken by U.S. President Trump.

Amid rising speculation that the U.S. economy could enter a recession, the U.S. dollar is weakening, and markets are pricing in three-quarter point rate cuts by the Fed this year. A weaker dollar makes gold cheaper for foreign buyers, while lower interest rates enhance gold's appeal.

Fed officials want to see further progress on inflation before continuing with rate cuts, or a weakening labor market could push them to ease policy. Recent data indicates that the labor market is moderating but remains solid.

In this context, Wednesday's inflation report will be crucial for Fed rate expectations. If the data shows that price pressures in the U.S. are easing, it will likely support gold's upward momentum.